Nasdaq First North

Nasdaq First North Growth Market is an alternative market, operated by the different exchanges within NASDAQ OMX. It does not have the legal status as an EU-regulated market. Companies at Nasdaq First North Growth Market are subject to the rules of Nasdaq First North Growth Market and not the legal requirements for admission to trading on a regulated market. The risk in such an investment may be higher than on the main market. All companies with shares traded on Nasdaq First North Growth Market have a Certified Adviser who monitors that the rules are followed. The Exchange approves the application for admission to trading on Nasdaq First North Growth Market.

Important information about Nasdaq First North Growth Market

“Nasdaq First North Growth Market is a registered SME growth market, in accordance with the Directive on Markets in Financial Instruments (EU 2014/65) as implemented in the national legislation of Denmark, Finland and Sweden, operated by an exchange within the Nasdaq group. Issuers on Nasdaq First North Growth Market are not subject to all the same rules as issuers on a regulated main market, as defined in EU legislation (as implemented in national law). Instead they are subject to a less extensive set of rules and regulations adjusted to small growth companies. The risk in investing in an issuer on Nasdaq First North Growth Market may therefore be higher than investing in an issuer on the main market. All issuers with shares admitted to trading on Nasdaq First North Growth Market have a Certified Adviser who monitors that the rules are followed. The respective Nasdaq exchange approves the application for admission to trading”

Click here to view information about the Firefly AB stock: FIRE

Shareholder Structure

Updated 2025-06-30

| Structure | Number of Shareholders | Number of Shares | % |

|---|---|---|---|

| 1-500 | 2 611 | 255 244 | 4.25 |

| 501-1 000 | 202 | 160 609 | 2.68 |

| 1 001-5000 | 175 | 405 516 | 6.74 |

| 5 001-10 000 | 21 | 145 474 | 2.42 |

| 10 001-15 000 | 15 | 189 818 | 3.16 |

| 15 001-20 000 | 5 | 91 466 | 1.52 |

| 20 001- | 28 | 4 754 273 | 79.22 |

| TOTAL | 3 057 | 6 001 400 | 100 |

Major Shareholders

Updated 2025-06-30

| NUMBER OF SHARES | VOTES % | |

|---|---|---|

| Erik Mitteregger Förvaltnings AB | 2 300 000 | 38.32 |

| Magnus Vahlquist | 450 000 | 7.50 |

| Birgitta Svensson | 330 000 | 5.50 |

| Avanza Pension | 272 825 | 4.55 |

| Saxo Bank | 217 614 | 3.63 |

| Arding Language Services AB | 129 000 | 2.15 |

| Nordnet | 110 132 | 1.84 |

| Christina Vahlquist | 100 000 | 1.67 |

| Willmar Andersson | 78 649 | 1.31 |

| Odin Fonder | 77 000 | 1.28 |

| Total 10 major shareholders (votes) | 4 065 412 | 67.74 |

| Total other owners, 3 047 | 1 935 988 | 32.26 |

| Total | 6 001 400 | 100,0 |

Insider Holdings

Holdings and transactions of the board of directors, management and other persons discharging managerial responsibilities and persons closely associated with a person discharging managerial responsibilities:

| BOARD | SHARES | |

|---|---|---|

| Erik Mitteregger, Chairman | 2 300 000* | |

| Elisabet Salander Björklund | 3 400 | |

| Anders Lindberg | 3 450 | |

| Lennart Jansson | 79 250 | |

| Jan Berntsson | 15 000 |

*includes holding via companies

| MANAGEMENT TEAM | SHARES | |

|---|---|---|

| Anders Bergström, CEO | 23 445 | |

| Agneta Thelander, CFO | 260 | |

| Karla Yunuen Kvistedal, Director of Product and Strategic Accounts | 50 | |

| Henrik Gustafsson, Operations Manager | 0 | |

| Roger Elmberg, Production Manager | 0 |

| OTHER | SHARES | |

|---|---|---|

| Beata Lihammar, Authorized Accountant, BDO Mälardalen AB, auditor in charge | 0 |

Data per Share

Updated 2023-12-31

| 2023 | 2022 | 2021 | 2020 | 2019 | ||

|---|---|---|---|---|---|---|

| Earnings per share, SEK | 7.54 | 5.81 | 3.49 | 2.91 | 2.95 | |

| Market value, SEK Share price year end | 174.0 | 88.0 | 85.0 | 58.8 | 54.2 | |

| P/E ratio | 23.1 | 15.1 | 24.4 | 20.2 | 18.4 | |

| Equity capital per share, SEK | 24.62 | 19.90 | 16.49 | 15.08 | 12.17 | |

| Dividend per share, SEK | 4.75 | 3.00 | 2.5 | 2..10 | – | |

| Dividend yield, % | 2.7 | 3.4 | 2.9 | 3.6 | – | |

| Cash flow from operating activities per share, SEK | 6.87 | 0.24 | 5.42 | 3.17 | 2.02 | |

| Number of shares year-end | 6 001 400 | 6 001 400 | 6 001 400 | 6 001 400 | 6 001 400 |

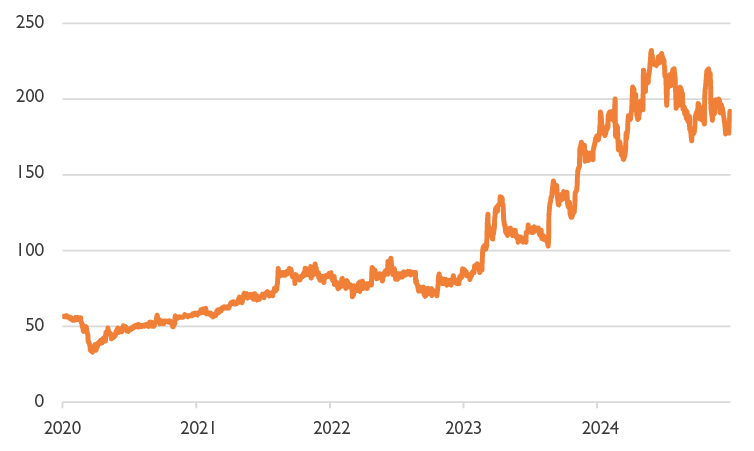

Share trend

Sharetrend 2020-2024

Dividend policy

Firefly will endeavor the divided to shareholders to an annual amount equal to 2/3 of net profit after taxes. The dividend can deviate from this level when the objective for the capital structure is not fulfilled or the Board of Directors estimate that the company, taking into account growth and acquisition opportunities and economic situation, is overcapitalized.

Dividend history

| Dividend history | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Dividend per share, kr | 5.50 | 4.75 | 3.00 | 2.50 | 2.10 |

| Total dividend, mkr | 33.0 | 28.5 | 18.0 | 15.0 | 12.6 |

Prenumerera

Via länken nedan kan du prenumerera på pressmeddelanden och finansiella rapporter. Om du vill avsluta prenumerationen på ett befintligt abonnemang är detta också platsen att göra det på.